Diligent saving and investing lead to early retirement

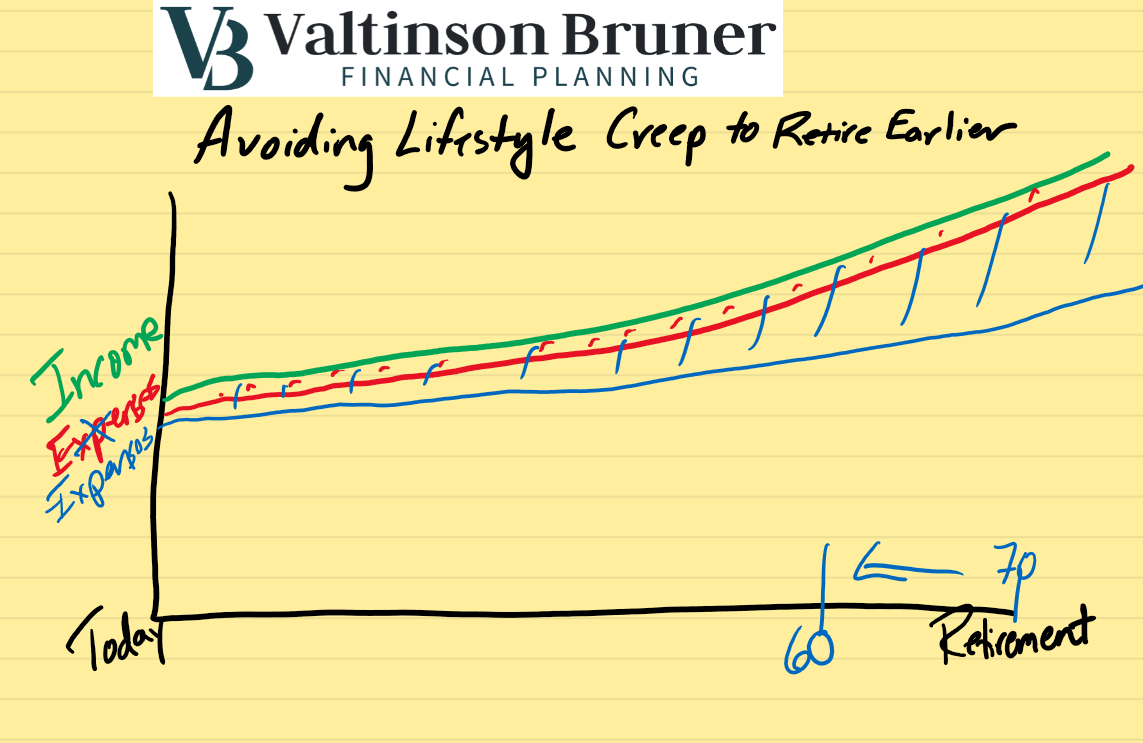

As you progress through your career, it’s important to avoid letting your expenses increase at the same rate as your income. If you’re able to keep expenses reasonable and save the gap between income and expenses, you can set yourself up for an early retirement.

According to Forbes, as people earn raises in their career, lifestyle expectations change. If you want to chat about how we can guide you to avoiding lifestyle creep and enjoying an earlier retirement Start Here

Watch the video here:

Video Transcript:

Hi, this is Rob Bruner at Valtinson Bruner financial planning. And today we’re talking about avoiding lifestyle creep to retire earlier.

So all of us are starting at some point here today and are hoping to retire at some point out here in the future. We all have a certain level of income that’s coming in the door and over time we hope that income grows as well.

We go along in our career. We also have expenses over time. If we let our expenses creep up with our income, then we only have this small gap to save between our income and expenses. Another way to look at it hopefully is to get us to an earlier retirement we keep expenses a little more reasonable over time and create a bigger gap that we can save between our income and expenses.

And what that can do is that can take a retirement here at 70 and move it earlier to potentially maybe age 60 or earlier, if you’d want to get in touch with us to talk about that concept and how we can help you retire earlier, please visit our website @ www.valtinsonfinancial.com

Or give us a call at the office here at 651-628-9832. Thank you.