Efficient retirement withdrawals can lead to higher retirement income

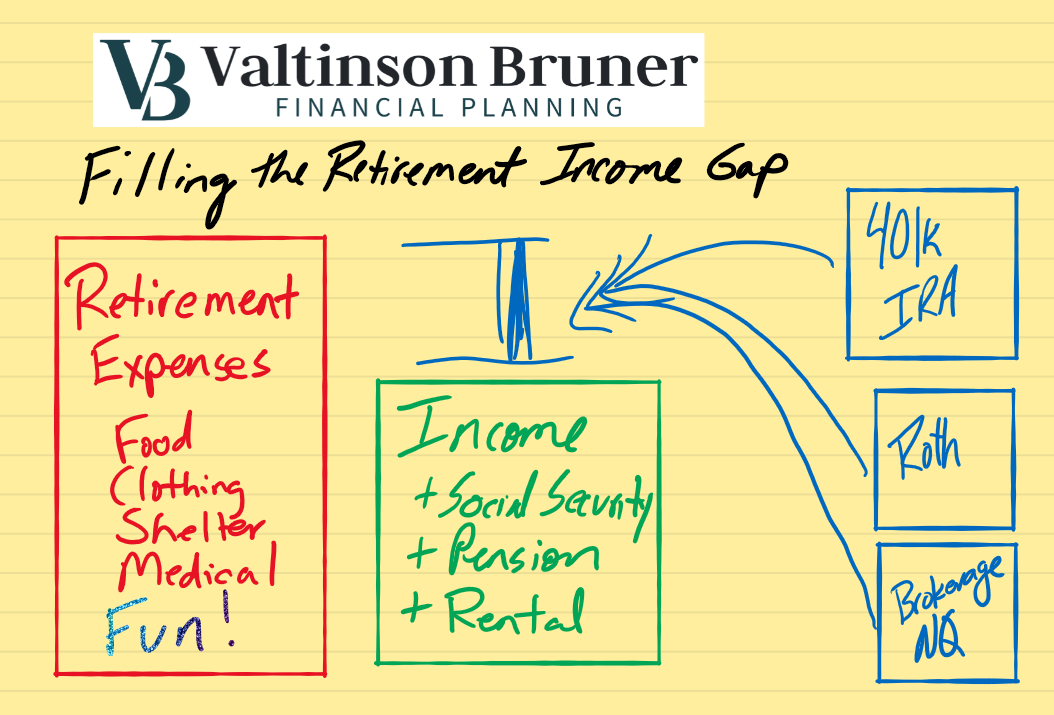

Efficient retirement withdrawals can be confusing. In this video we discuss the basics of account withdrawals during retirement. Retirement expenses include the basics like food, clothing, shelter, and medical expenses. But you also want to account for the fun expenses like vacations and hobbies. To pay for these expenses you have income sources such as Social Security, pensions or rental property. For most people, there is a gap between their expenses and their income sources. This gap needs to be filled by withdrawals from their investment accounts. A plan for account withdrawals is a crucial part of retirement income planning.

If you want to learn more about efficient account withdrawals during retirement, schedule a call with us here

Watch the video:

Video Transcript:

Hi everybody. This is Rob Bruner at Valtinson Bruner Financial Planning on today’s Sketchpad Simple we’re talking about filling the retirement income gap.

And what we’re talking about here is we have some retirement expenses. Let’s talk about what those expenses might be. Number one, we got food, we got clothing, we got shelter or house and property tax and things like that.

We also are going to have some medical expenses. And then of course, we want to have some fun expenses during retirement and our income sources during retirement. From an income source standpoint, we’re going to have social security. We’re going to have potentially a pension.

Not everybody has those these days. And potentially you might have some rental income. Now For most people, retirement expenses, aren’t totally covered by social security, pensions and rental income so there is what we call the retirement income gap right here. That needs to be filled by your investments.

And what are some of the investment accounts we have, we got 401k or IRA pre-tax money. We might have some Roth money and you might have a brokerage account or what we sometimes call a non-qualified account.

It’s a non IRA or non Roth. And so the key part of retirement income planning is determining. At what point do we take from certain buckets of money?

And it might be, in some years, we’re taking from all three, we’re taking from 401k and IRA. We’re taking from Roth and we’re taking from brokerage.

But the key part is looking at the different accounts and determining what piece and how much from each account is going to go to fill this retirement income gap and give you the retirement income you need to have a great and fulfilling retirement. If you have any questions or want to discuss retirement income planning, please get in touch with us at www.valtinsonfinancial.com or give the office a call at (651) 628-9832.

Thank you.